how are annuities taxed to beneficiaries

If the beneficiary selects a lump sum payment they must pay taxes. Inherited annuities are taxable as income.

How To Avoid Probate People Thinks It S Only For The Rich If You Own Over 25k Cash Then You Mus Estate Planning Checklist Estate Planning Funeral Planning

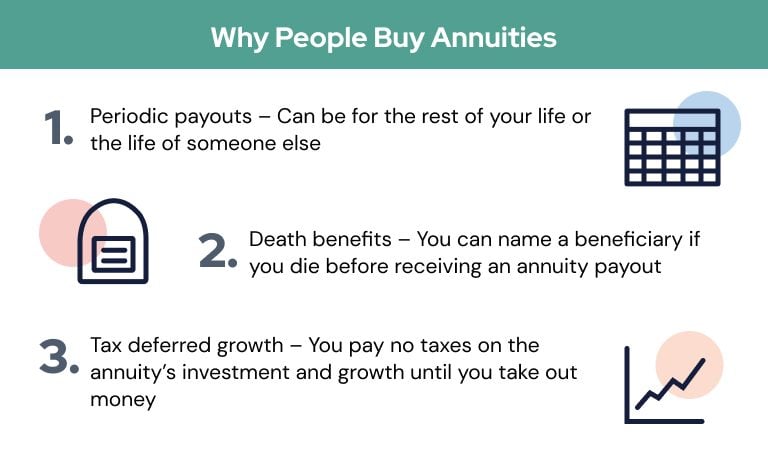

In particular most annuities have a death benefit and understanding how that death benefit will get taxed to the beneficiary who receives it is an important part of deciding.

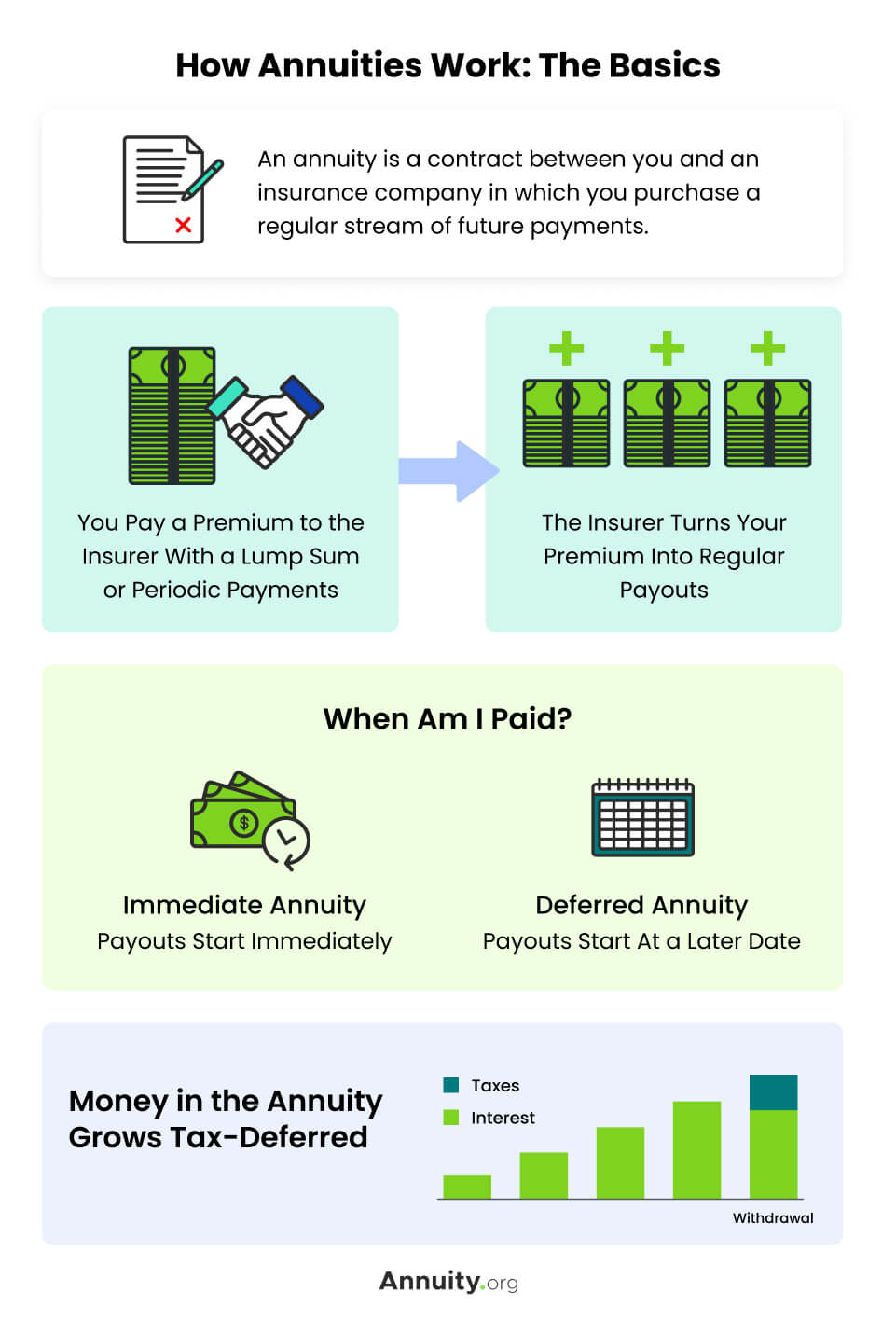

. What this means is taxes are not due until you receive income payments from your annuity. For non-spouse beneficiaries of qualified annuities taxes depend on the payout structure that the beneficiary selects. If you inherit an annuity youll have to pay income tax on the difference between the principal paid into the annuity and the value of the annuity when the owner dies.

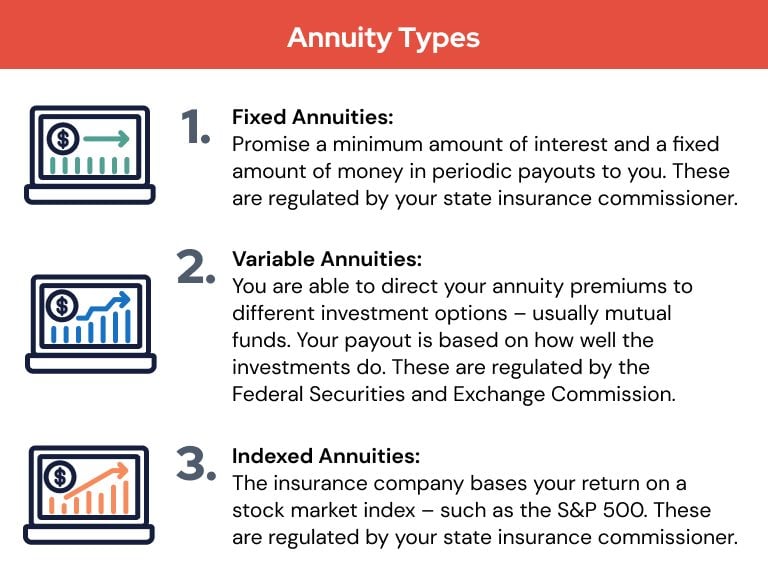

To avoid taxes on inheritance for your beneficiaries utilize a deferred annuity or a life insurance policy. An annuity is qualified if you purchase it with pre-tax dollars via a tax-advantaged account such as an IRA or 401k. Inherited Non-Qualified Annuity Taxes.

Annuities offer enhanced death benefits to allow beneficiaries to offset. How the beneficiary is taxed depends on whether they receive the annuity in a lump sum or. Ad Learn More about How Annuities Work from Fidelity.

A surviving spouse can continue the annuity. Learn some startling facts. Nonqualified annuities do not provide a step-up in tax basis to the date of death for the designated beneficiary.

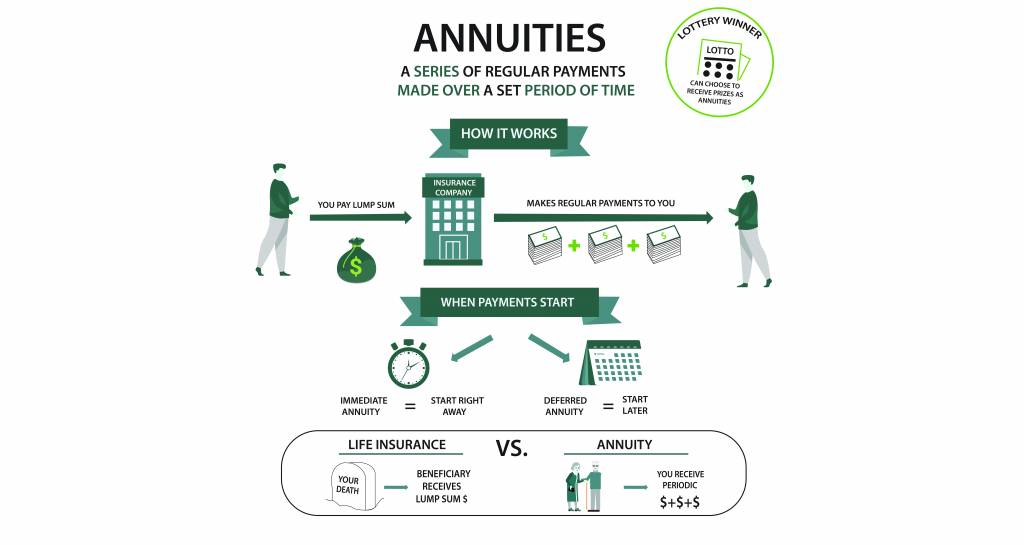

You cant completely avoid paying taxes when you inherit an annuity. The beneficiary of a tax-deferred annuity may choose from several payout options which will determine how the income benefit will be taxed. Annuities are tax deferred.

Annuities are often complex retirement investment products. Understanding how inherited annuities are taxed starts with knowing the difference between qualified and non-qualified annuities. How Inherited Annuities Are Taxed.

The simplest option is to take the entire amount as a lump sum. Your beneficiaries have a few options for dealing with the inherited annuity -- and the tax bill it triggers. How are annuities taxed when distributed.

Ad Learn More about How Annuities Work from Fidelity. If its a non-qualified annuity you wont have to pay income. But there are things you can do to minimize the tax hit.

Beneficiaries need not worry about having to pay taxes on their entire. In the case of eligible annuities you will be taxed on the entire withdrawal amount. Beneficiaries of Period-Certain Life Annuities.

The IRS treats distributions paid to an annuitant from qualified. Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

For example if the owner. Some annuities are period-certain annuities which combine the benefits of a fixed annuity and life annuity by guaranteeing both. However an investment annuity sold by an insurance.

This means the money was already taxed before it was put into the annuity. Life insurance is an exempt asset for PA inheritance tax purposes no matter the amount or who the beneficiary is. The basis or monetary contribution that purchased the annuity is not taxed.

With non-qualified annuities funds come from post-tax dollars. If the beneficiary is entitled to receive a survivor annuity on the death of an employee the beneficiary can exclude part of each annuity payment as a tax-free recovery of. But that doesnt mean theyre a way to avoid taxes completely.

038 Pension Payment Or Lump Sum Which One Do You Take In 2021 Annuity Annuity Quotes Pensions

Annuities Explained Information Annuity Basics

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Annuity Beneficiaries Inheriting An Annuity After Death

Fidelity Guaranty Life Safe Income Plus Annuity Review Annuity Income Saving For Retirement

Secure Act Retirement Planning Opportunities And Challenges Retirement Planning Lifetime Income Financial Advisors

Annuity Taxation How Various Annuities Are Taxed

Abney Associates Ameriprise Financial Advisor In Melville Ny Ameriprise Financial Financial News Financial

Annuity Taxation How Various Annuities Are Taxed

Abney Associates Ameriprise Financial Advisor In Melville Ny Ameriprise Financial Financial News Financial

Using Annuities For Spendthrift Protection In Estate Planning

Do You Know Who Your Beneficiaries Are Rochester Ny Www Wealthmg Com Financial Planner Did You Know Wealth Management

Annuity Beneficiaries Inherited Annuities Death

Qualified Vs Non Qualified Annuities Taxes Rmd Retireguide

How Annuities Work Examples By Type Considerations

Annuities Explained Information Annuity Basics

Annuity Beneficiaries Inheriting An Annuity After Death