capital gains tax changes 2020

Ad If youre one of the millions of Americans who invested in stocks. A Guide to Understand Your Options With RSUs Deferred Comp Plans More.

Reap The Benefits Of Tax Loss Harvesting To Lower Your Tax Bill Investing Income Tax Preparation Capital Gains Tax

Capital gains tax rates on most assets held for a year or less.

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

. The filing of capital gains tax CGT returns and the payment of CGT arising from the disposal of chargeable assets in a particular year is due on or before June 30 and. 401 k income limits. The deadlines for paying Capital Gains Tax after selling a residential property in the UK are changing from 6 April 2020 - understand the changes and what you need to do.

What were the Capital Gains Tax changes. Payable within 30 days. Ad Wealth Enhancement Group Provides Comprehensive Financial Guidance Nationwide.

Capital Gain Tax Rates. Learn all about capital gains tax here. Capital Gains Tax Rate Threshold 2021 Capital Gains Tax Rate Threshold 2020 0.

Thirty-five states have major tax changes taking effect on January 1 2020. Previously it was not necessary to report or pay CGT until you submitted your. PPR Relief last 9 months.

Rocky Mengle Senior Tax Editor. In 2018 the IRS significantly reduced the. The Lowdown on Capital Gains Tax Rates for 2020 and Beyond Rates for long-term capital gains are based on set income thresholds that are adjusted annually for inflation.

In 2022 individuals under the age of 50 can contribute 20500. In the 2018 Budget former Chancellor Phillip Hammond announced a couple of changes to the capital gains tax CGT regime and reliefs available to owners of a residential. For those 50 or older the catch-up contribution limit.

2020 capital gains tax thresholds for single filers. IRS Restores Capital Gains Tax and Other Tax Return Changes for 2020 Ready or not the tax return changed again during the 2020 tax season. The main changes that were made to Capital Gains Tax were regarding the deadlines for paying it after selling a residential property.

If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0 15 or. The 2019 to 2020 tax year is the last year UK residents will be required to pay the Capital Gains Tax for the sale of properties as part of the Self Assessment process and we. 3 minutes agoThe settlement covers the states legal fees and sets up restitution fund and a state pay-out but a pending Pennsylvania lawsuit is likely the first of many to follow.

This is up from 19500 in 2021. Capital Gains Tax changes April 2020 1. Before completing your taxes this year understand how capital gains tax works and how new changes affect your filing.

Capital Gains Tax Rate Threshold 2021 Capital Gains Tax Rate Threshold 2020 0. Some or all net capital gain may be taxed at 0 if your taxable. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

6 hours agoChanges the asset manager made in December 2020 allegedly stuck customers with extraordinary capital gains and big tax bills according to Massachusetts securities. The capital gains tax CGT system could be made simpler and fairer by reducing the annual exempt amount and raising rates to match income. Former Vice President Joe Bidens tax plan would take away the preferential 20 maximum capital gains rate for those with income levels about 1 million.

Long-Term Capital Gains Taxes. Or sold a home this past year you might be wondering how to avoid tax on capital gains. Arkansas Tennessee and Massachusetts will each see reductions in their individual income.

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the 22. The tax rate on most net capital gain is no higher than 15 for most individuals.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Tax What Is It When Do You Pay It

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Paul Ryan Budget Business Insider Capital Gains Tax Budgeting Income Tax Brackets

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

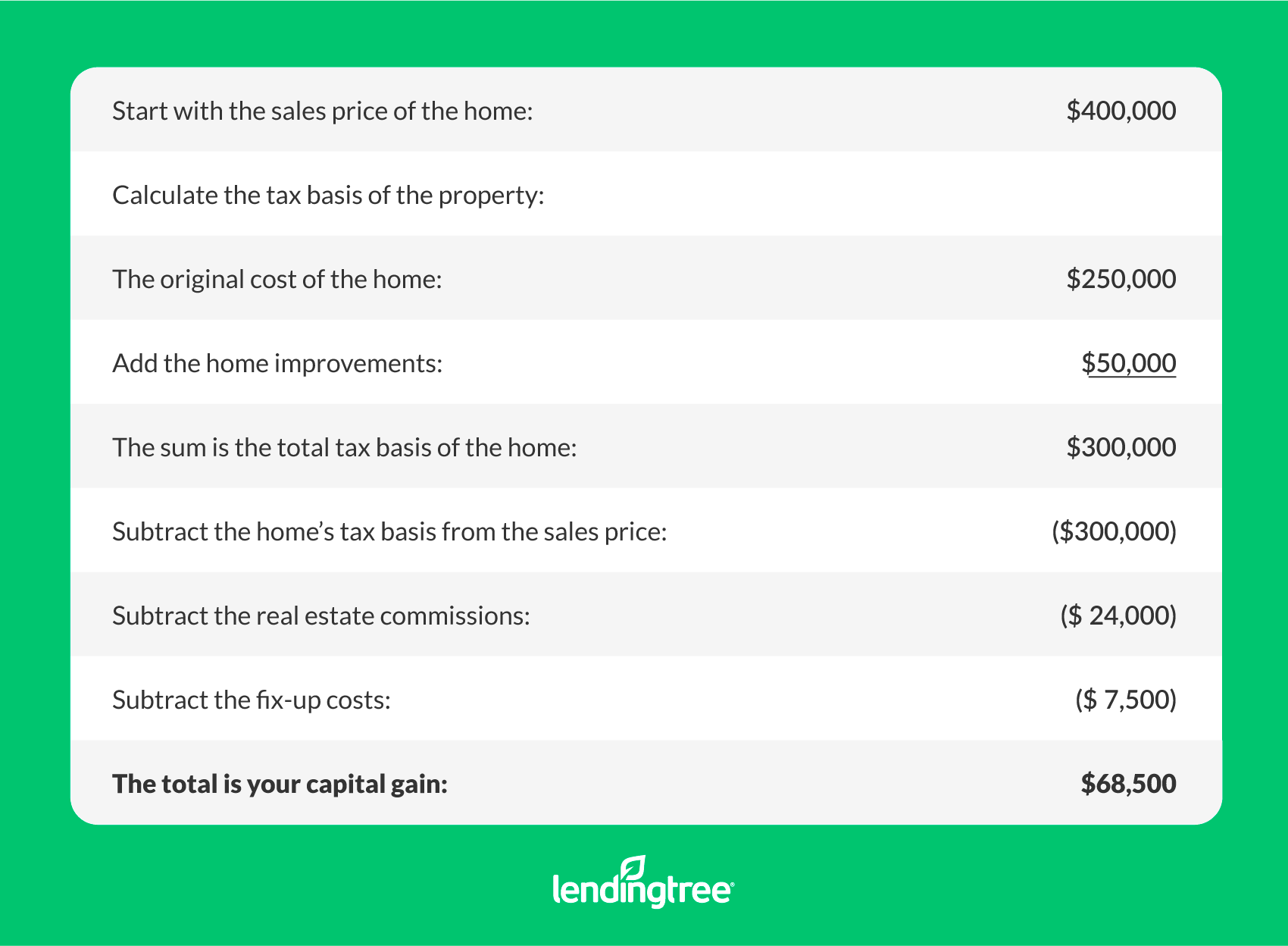

Capital Gains Tax On A Home Sale Lendingtree

What Are The Capital Gains Tax Rates For 2020 And 2021 Financial Stocks Stock Market Capital Gains Tax

How To Pay 0 Capital Gains Taxes With A Six Figure Income

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How Much Tax Will I Pay If I Flip A House New Silver

Income Tax Expectations What Income Tax Changes To Expect From Budget 2020 Budgeting Personal Finance Economy

How Your Brokerage Account Is Taxed

How High Are Capital Gains Taxes In Your State Tax Foundation

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)